Berkshire Hathaway, the conglomerate led by Warren Buffett, found itself in a unique position last quarter as its cash pile swelled to a record $276.9 billion. This marked a significant increase from the previous record of $189 billion, demonstrating the company’s continued ability to generate substantial reserves. However, this increase in cash holdings was accompanied by a series of significant stock sales, including a reduction in the company’s stake in Apple by nearly half.

Warren Buffett, often referred to as the Oracle of Omaha, has been actively selling off stocks for the past seven quarters. However, the pace of selling accelerated in the last period, with Buffett offloading more than $75 billion worth of equities. This trend continued into the third quarter, with Berkshire trimming its second-largest stake in Bank of America for 12 consecutive days. Despite this selling spree, Berkshire’s operating earnings saw a healthy jump in the second quarter, fueled by the performance of its fully-owned businesses.

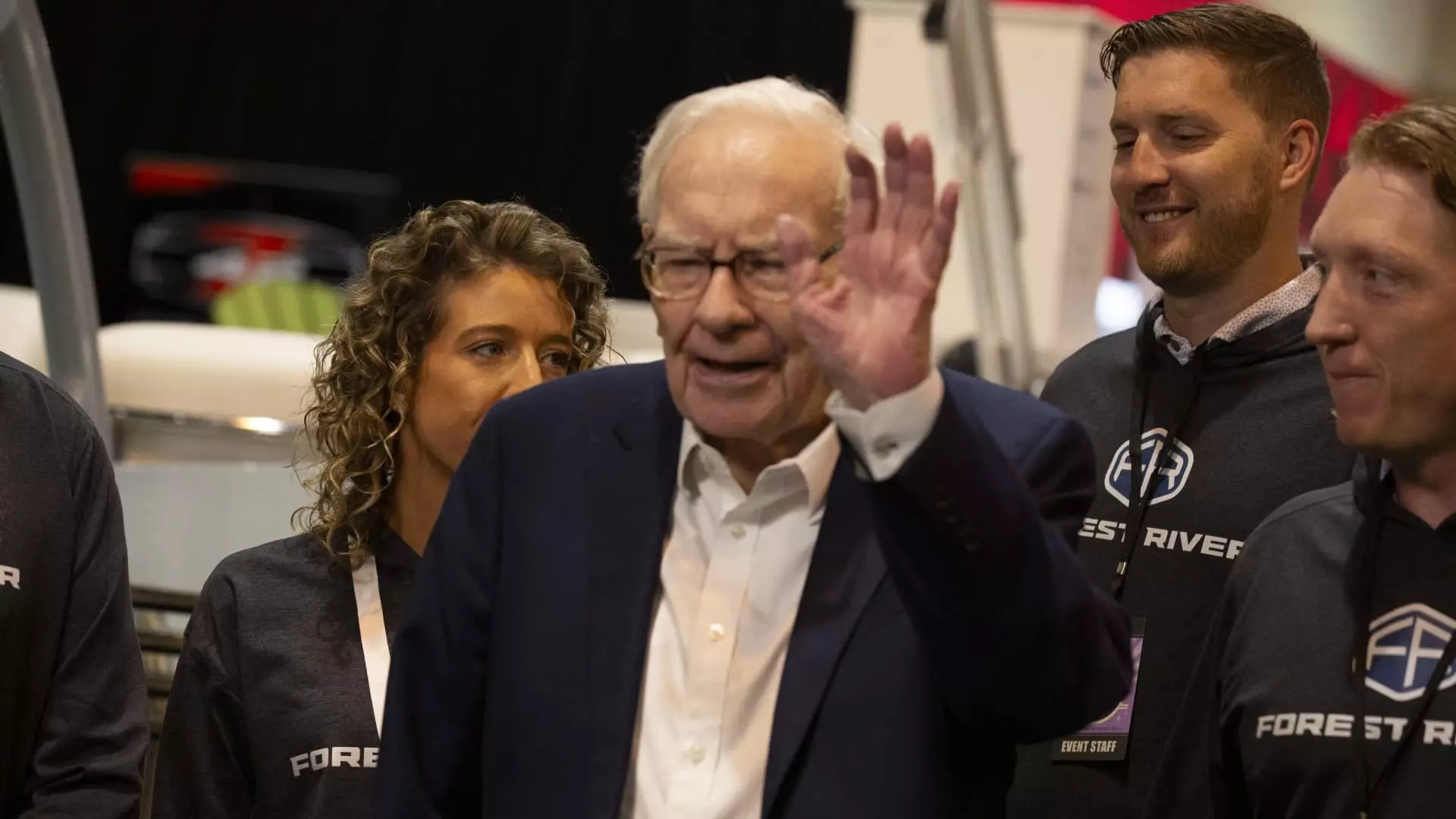

As Buffett approaches his 94th birthday, he remains cautious about deploying the company’s massive cash reserves. Despite expressing a willingness to invest, high prices in the market have given him pause. Buffett emphasized the need for investments with low risk and high return potential, indicating that he values prudent decision-making over impulsive spending. This cautious approach is reflected in Berkshire’s reduced stock buybacks in the second quarter, signaling a focus on value creation rather than market speculation.

Market Concerns and Economic Outlook

The recent performance of the S&P 500, which has surged to record levels in the past two years, has been driven by investor optimism and Federal Reserve policies. However, concerns about a potential economic slowdown have emerged, fueled by weak data such as the disappointing July jobs report. The recent decline in the Dow Jones Industrial Average and growing apprehensions about the technology sector’s valuations have added to the uncertainty in the market. Despite these challenges, Berkshire Hathaway’s core businesses, such as Geico and BNSF Railway, have shown resilience in generating profits, underscoring the company’s diversified portfolio strategy.

Conclusion: Navigating Volatility and Uncertainty

As Berkshire Hathaway navigates a period of market volatility and economic uncertainty, Warren Buffett’s strategic decisions and cautious approach to capital allocation will be closely watched. The company’s record cash reserves, coupled with its history of long-term value creation, position it well to weather challenging market conditions. While the short-term outlook remains uncertain, Buffett’s emphasis on fundamental investing principles and discipline in capital deployment are expected to guide Berkshire Hathaway through this period of turbulence.