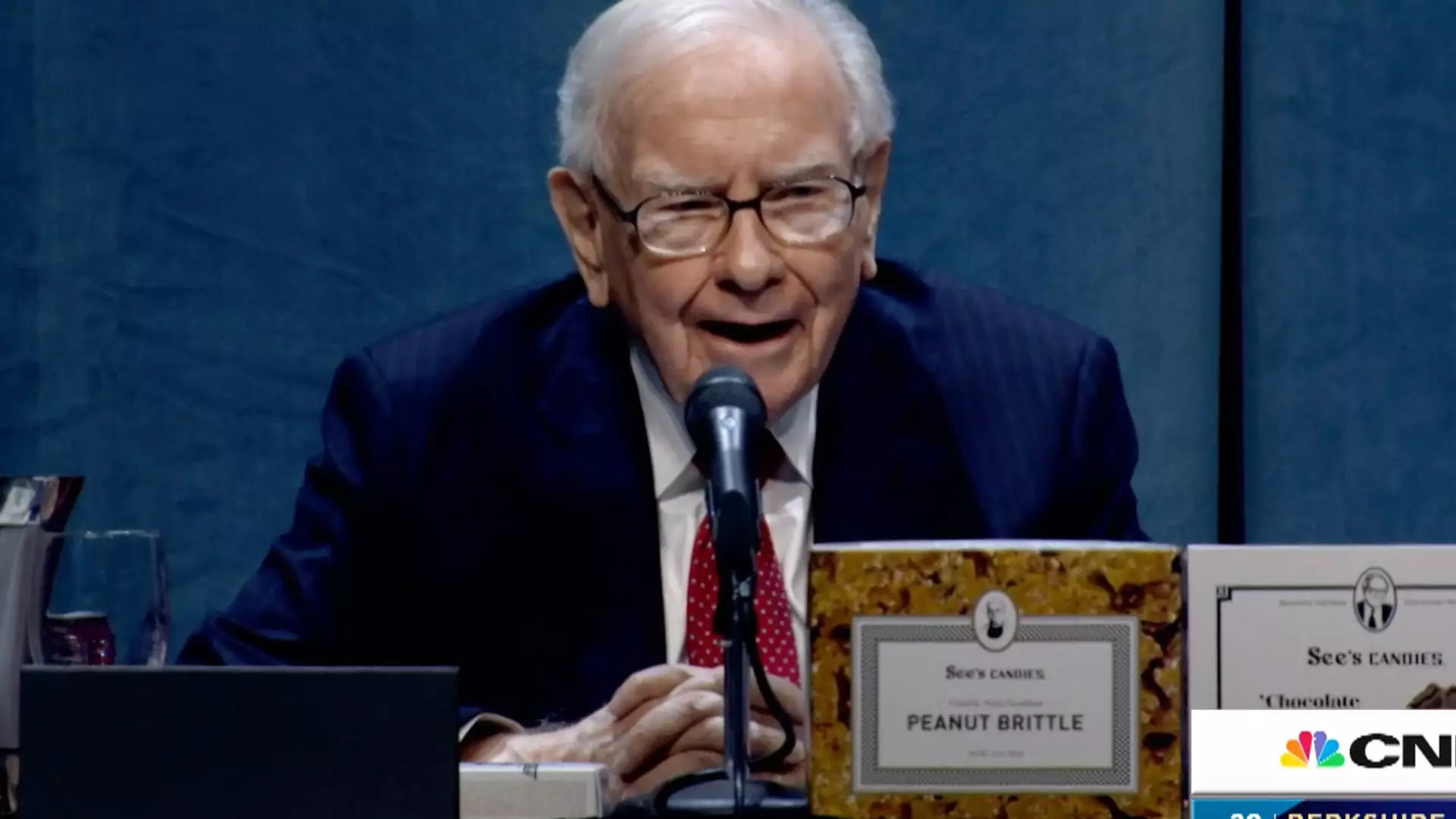

Warren Buffett, known for his astute investment acumen and candid remarks, recently shared his thoughts on President Donald Trump’s tariff policies, offering an analysis that reflects both historical insights and current economic concerns. In a rare commentary, Buffett pointed out that tariffs function similarly to taxes levied on consumers, underscoring their potential to trigger inflation and impact the cost of living. As the CEO of Berkshire Hathaway, his commentary carries weight, especially considering the company’s varied investments across industries such as insurance, railroads, and manufacturing.

In an interview for a documentary about Katharine Graham, the esteemed publisher of The Washington Post, Buffett articulated his concerns with a blend of wit and wisdom. He remarked, “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” His light-hearted yet serious tone illustrates a critical economic principle: tariffs do not magically disappear; instead, they are ultimately passed down to consumers. This perspective draws attention to the ripple effects that trade policies can have on the everyday lives of individuals.

As the economic landscape shifts under the weight of aggressive tariff measures—recently announced by Trump, which include a substantial 25% on imports from Mexico and Canada—Buffett’s insights call for careful consideration. He warns that retaliatory actions from countries such as China could exacerbate the situation, leading to a tit-for-tat escalation that undermines global trade stability. The billionaire investor has previously voiced skepticism regarding the intensity of trade conflicts and their potential to disrupt not just national economies but also the global market.

Buffett’s commentary also reveals a deeper skepticism regarding the current state of the U.S. economy. While he refrained from making sweeping predictions during the CBS interview, his reluctance to delve into the economic outlook suggests an acute awareness of the uncertainties that loom ahead. By alluding to the idea of “And then what?” Buffett encourages a thoughtful approach to economic policies, urging stakeholders to consider long-term consequences rather than short-term gains.

In a notable shift, Buffett has recently adopted a more cautious investment strategy, offloading stocks and amassing substantial cash reserves. This defensive stance has raised eyebrows among analysts, with interpretations ranging from a bearish outlook on the market to a strategic preparation for a successor at Berkshire Hathaway. The volatile market conditions—characterized by fluctuating economic indicators and unpredictable policy changes—have made many investors wary. As concerns over slowing economic growth and inflated stock valuations persist, the S&P 500 has seen only marginal gains this year.

Warren Buffett’s insights on tariffs encapsulate not just his concerns about current trade policies, but also highlight the broader implications on the economy. His experienced perspective underscores the necessity for careful deliberation in economic decision-making, especially in times of uncertainty. As global trade dynamics evolve, the need for clear, strategic policies becomes ever more critical, reminding us that the choices made today can have lasting impacts on both consumers and the economy at large.