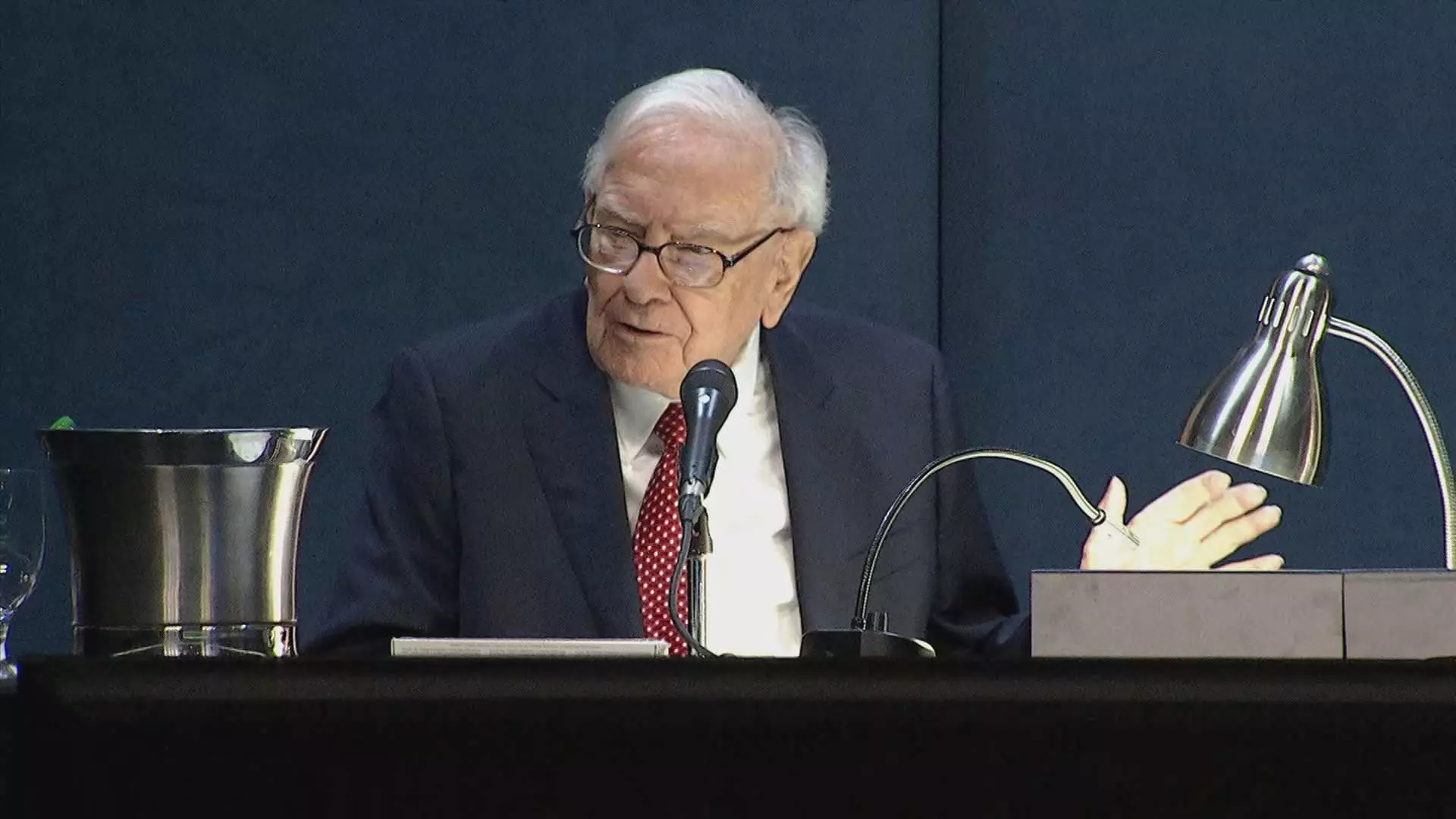

Warren Buffett, also known as the “Oracle of Omaha,” has made headlines after it was discovered that he now owns an equal number of shares in both Apple and Coca-Cola. This comes after he slashed his holding in the tech giant by half, leaving many wondering if this was a mere coincidence or part of a larger strategic plan.

Buffett’s decision to hold the exact same 400 million shares in Apple and Coca-Cola has sparked speculation among investors. Some believe that Buffett’s preference for round numbers may indicate that he has no intention of selling any additional shares of Apple in the near future. This aligns with his long-standing strategy of treating Coca-Cola as a “permanent” holding, which he has maintained for over 30 years.

Buffett’s relationship with Coca-Cola dates back to 1988 when he first purchased shares in the company. Over the years, he steadily increased his stake to reach the current 400 million share count. Buffett’s affinity for Coca-Cola stems from his childhood, where he recognized the consumer appeal and commercial potential of the iconic soft drink. This longstanding investment in Coca-Cola reflects his belief in the company’s enduring value.

Apple: A Consumer Products Company

Despite being primarily known for his value investing approach, Buffett’s investment in Apple defies traditional conventions. He views the tech giant as a consumer products company similar to Coca-Cola, emphasizing the loyalty of iPhone users and the company’s significance in the market. Even as Berkshire Hathaway reduced its stake in Apple by over 49% in the second quarter, Buffett’s underlying confidence in the company remains steadfast.

The reduction in Berkshire’s stake in Apple was met with speculation about the reasoning behind the move. While some viewed it as a strategic portfolio adjustment, others believed it reflected a broader market outlook. The resulting equal share count in Apple and Coca-Cola, along with Buffett’s comparison of both companies at Berkshire’s annual meeting, suggests a deliberate and calculated approach to investment management.

Warren Buffett’s equal investment in Apple and Coca-Cola offers a window into his investment philosophy and strategic decision-making. Whether it is a mere coincidence or a master plan, Buffett’s ability to adapt to changing market dynamics while staying true to his core principles exemplifies his status as one of the most successful investors of our time. Ultimately, only time will reveal the true implications of Buffett’s latest investment move.