Warren Buffett’s Berkshire Hathaway has been steadily offloading Bank of America shares, with the total sales surpassing $7 billion since mid-July. The conglomerate reduced its stake to 11% after shedding 5.8 million BofA shares in separate sales. This latest action marks the 12th consecutive selling streak by Berkshire, matching the previous streak from July 17 to Aug. 1.

Following the recent sales, Bank of America now falls to the third spot on Berkshire’s list of top holdings, trailing behind Apple and American Express. Prior to the selling spree, BofA had been the conglomerate’s second biggest holding. Buffett initially invested $5 billion in BofA’s preferred stock and warrants back in 2011, after the financial crisis, making Berkshire the largest shareholder in the bank.

Brian Moynihan, CEO of Bank of America, made a rare comment regarding Berkshire’s ongoing sales. He mentioned that he does not have knowledge of Buffett’s motivations for selling, but acknowledged that the market is absorbing the stock. Moynihan praised Buffett’s investment in BofA in 2011, which helped stabilize the bank during a challenging period.

Shares of Bank of America have only dipped about 1% since the beginning of July, with the stock showing a 16.7% increase for the year, slightly outperforming the S&P 500. Moynihan highlighted the lucrative nature of Buffett’s investment in BofA, stating that investors who bought the stock at the same time as Buffett would have seen significant returns.

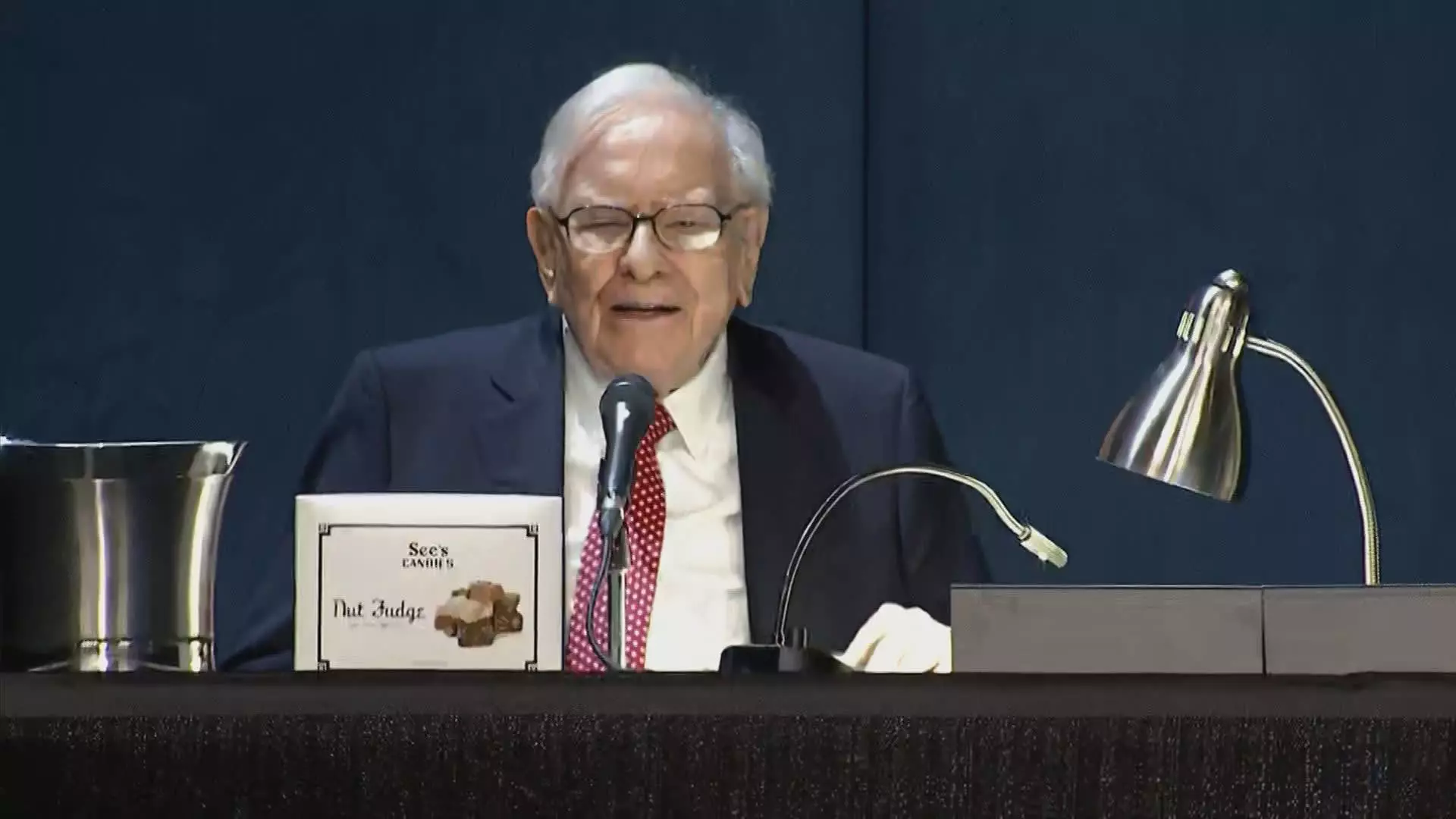

Warren Buffett’s Berkshire Hathaway’s continuous selling of Bank of America shares has been a strategic move that has garnered attention in the market. Despite the decline in Berkshire’s stake in BofA, the conglomerate’s investment history with the bank remains notable. Moynihan’s appreciation of Buffett’s investment decisions reflects a broader sentiment of respect and admiration for the “Oracle of Omaha.”