China’s economic data, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI), plays a crucial role in determining the value of the Australian Dollar (AUD). Understanding the relationship between these economic indicators and the AUD is essential for investors and traders looking to make informed decisions in the financial markets.

The recent data released by China indicates a rise in the CPI by 0.6% in August, slightly lower than the market consensus of 0.7%. On the other hand, the PPI declined by 1.8% year-on-year, worse than the forecasted -1.4%. This data suggests a mixed outlook for China’s economy, which has a direct impact on the Australian Dollar due to their strong trade relations.

Several factors influence the value of the Australian Dollar, with Chinese economic data being a significant driver. The level of interest rates set by the Reserve Bank of Australia (RBA) and the price of Iron Ore, Australia’s largest export, also play crucial roles in determining the AUD’s value. Additionally, market sentiment, inflation in Australia, growth rate, and Trade Balance are all factors that affect the AUD.

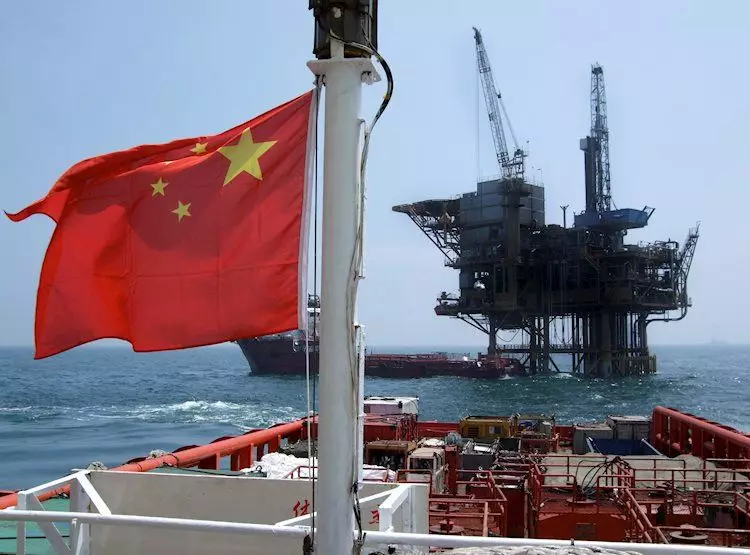

As Australia’s largest trading partner, the health of the Chinese economy has a direct influence on the Australian Dollar. Positive growth in China leads to increased demand for Australian exports, boosting the value of the AUD. Conversely, a slowdown in the Chinese economy negatively impacts the AUD. Therefore, any surprises in Chinese growth data can have a substantial impact on the Australian Dollar and its pairs.

Role of Iron Ore and Trade Balance

Iron Ore plays a crucial role in driving the value of the Australian Dollar, with higher prices resulting in an increase in the AUD’s value. Since China is the primary destination for Australian Iron Ore exports, any fluctuations in its price directly impact the AUD. Moreover, a positive Trade Balance, where exports exceed imports, strengthens the AUD, while a negative balance has the opposite effect.

Chinese economic data, particularly the CPI and PPI, has a significant impact on the value of the Australian Dollar. Understanding the interplay between these factors and the AUD is essential for investors and traders looking to navigate the financial markets successfully. By closely monitoring Chinese economic indicators and their implications for the AUD, market participants can make informed decisions and capitalize on potential opportunities.