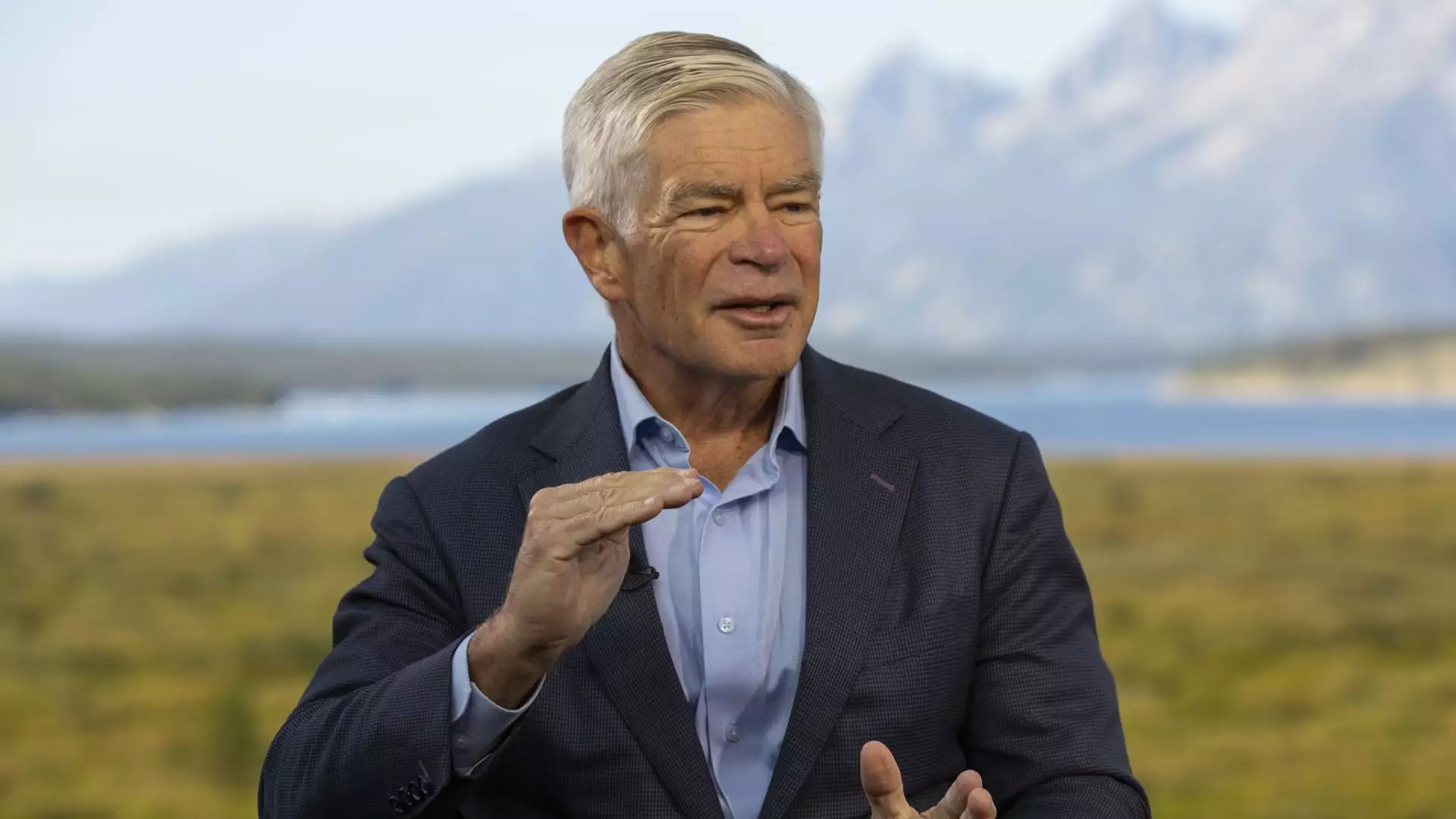

Philadelphia Federal Reserve President Patrick Harker made a bold statement at the Fed’s annual retreat in Jackson Hole, Wyoming, indicating that an interest rate cut is imminent. He emphasized the need to start the process of moving rates down methodically in September to address potential weaknesses in the labor market and inflation concerns.

With markets already pricing in a 100% certainty of a 25 basis point cut, and a 1-in-4 chance of a 50 basis point reduction, Harker acknowledged that the decision is not yet clear-cut. He mentioned the need for further data analysis before determining the exact magnitude of the rate cut.

Harker reiterated the importance of separating policy decisions from any political concerns, especially with the looming presidential election. He emphasized the Fed’s commitment to being proud technocrats who base their decisions on data analysis and appropriate responses to economic indicators.

Kansas City Fed President Jeffrey Schmid also expressed his views on the future of policy, leaning towards a rate cut due to rising unemployment rates. He highlighted the significance of the labor market cooling down and the need for further evaluation of the current economic conditions.

Although Harker does not have a vote this year on the rate-setting Federal Open Market Committee, he still contributes his input during meetings. On the other hand, Schmid will have a voting opportunity next year to directly impact policy decisions. Their perspectives collectively reflect a cautious approach towards potential rate cuts.

Overall, the statements from Harker and Schmid indicate a shift towards considering an interest rate cut in response to evolving economic conditions. The Fed’s commitment to data-driven decision-making, independent policy formulation, and future-oriented analysis suggests a proactive stance towards addressing economic challenges. As uncertainty looms in the financial markets, the need for a well-coordinated and strategic approach towards monetary policy becomes increasingly evident.