On a recent campaign stop in Nevada, U.S. Vice President Kamala Harris expressed her support for eliminating taxes on tips, echoing a similar stance taken by her opponent, former President Donald Trump. This move is strategic, as it aims to win over service workers, a crucial constituency in the state. Harris emphasized her commitment to fighting for working families by promising to raise the minimum wage and eliminate taxes on tips for service and hospitality employees. This aligns with her broader goal of driving down consumer prices by taking on big corporations that engage in illegal price-gouging and addressing issues such as rent hikes by corporate landlords and high drug prices set by pharmaceutical companies.

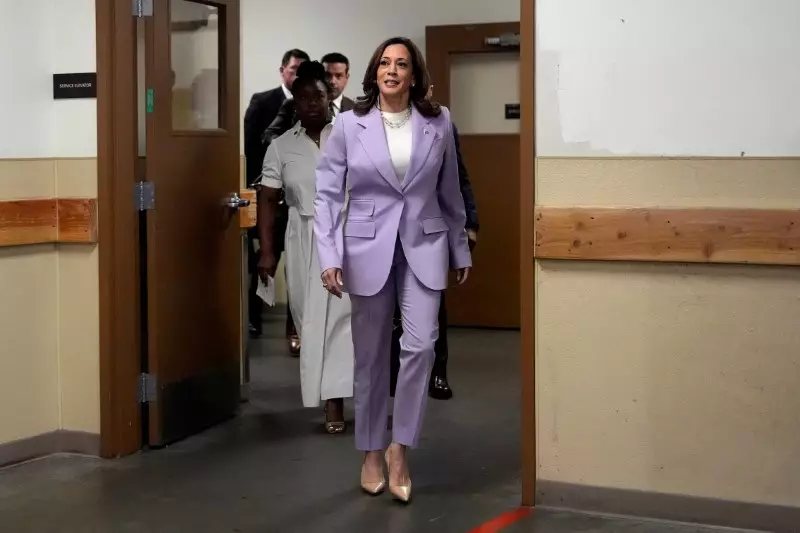

Harris, alongside her running mate Minnesota Governor Tim Walz, has been actively campaigning in battleground states such as Nevada, Wisconsin, Michigan, and Arizona. These states play a pivotal role in the presidential election, as winning them can significantly impact the final outcome. The Electoral College system requires candidates to secure 270 electoral votes to win the presidency, making swing states essential for both Harris and Trump. By focusing on these states, Harris aims to strengthen her position in the race and build on the momentum she has gained since becoming the Democratic nominee.

Despite Harris’ efforts to differentiate herself from Trump on various policy issues, she has faced criticism from the former president regarding her tax proposals. Trump accused Harris of copying his “NO TAXES ON TIPS” policy, highlighting their contentious relationship on key economic matters. The back-and-forth between the two candidates underscores the intense competition and scrutiny that characterize modern presidential campaigns. Additionally, Harris has encountered pushback from Trump’s campaign and supporters, who have questioned the credibility of polls showing her leading in pivotal states.

As the election draws closer, Harris remains focused on fundraising and expanding her voter base. Her campaign events have attracted large crowds, with thousands of supporters attending rallies across the country. Harris’ ability to raise hundreds of millions of dollars demonstrates her fundraising prowess and the enthusiastic support she has garnered from donors. However, she continues to face challenges from Trump and his allies, who seek to undermine her momentum and erode her lead in national polls.

In her campaign speeches, Harris has highlighted key policy differences between herself and Trump. One notable point of contention is their views on the Federal Reserve, where Harris vehemently opposes presidential interference with the independent institution. This stands in stark contrast to Trump’s previous statements advocating for greater presidential influence over the central bank’s decisions. These policy distinctions underscore the broader ideological divide between Harris and Trump on matters of economic policy and governance.

The competition between Kamala Harris and Donald Trump over tax policies reflects the broader ideological and strategic differences shaping the 2024 presidential race. As both candidates seek to rally support, secure crucial swing states, and articulate their policy visions, the battle for the White House intensifies. The outcome of this contest will not only determine the future direction of U.S. economic policy but also shape the country’s trajectory on key issues affecting working families and service workers.