In an era where digital interactions dominate everyday life, the responsibility of social media platforms in safeguarding users from fraud is increasingly scrutinized. Recent statements from British financial technology firm Revolut have brought this issue into sharp focus, highlighting a glaring shortcoming in Meta’s approach to combating fraud on its platforms. The crux of Revolut’s argument is that social media giants should bear direct financial accountability for scams facilitated through their services. This revelation shakes the foundation of how responsibility is perceived in the digital socioeconomic landscape.

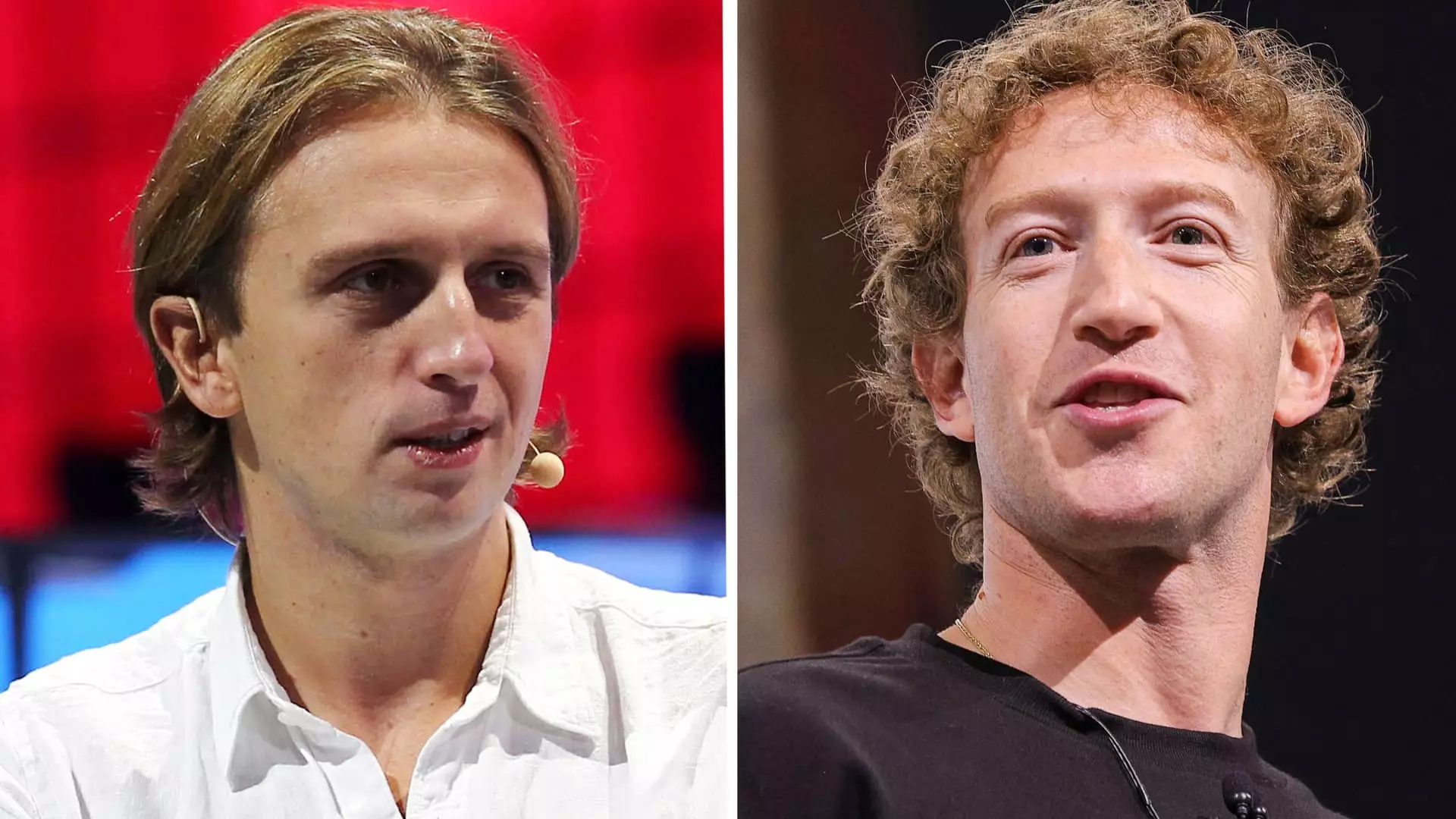

Revolut’s head of financial crime, Woody Malouf, was unequivocal in his criticism, asserting that Meta’s newly announced partnerships with U.K. banks NatWest and Metro Bank do not go far enough. While these collaborations aim to bolster data-sharing practices to prevent fraud, they fall short of ensuring that victims receive financial restitution. Malouf’s phrasing of “baby steps” starkly contrasts with the urgent need for transformative action in financial fraud prevention. This perspective raises vital questions about what measures imply genuine commitment versus superficial fixes.

Meta’s strategy appears reactive rather than proactive—primarily addressing symptoms of the problem without tackling its roots. The company’s unwillingness to compensate fraud victims raises ethical concerns. Users turning to social media for communication and connection should not have to bear the brunt of societal betrayal when scams erupt within these digital safe havens. Meta’s current model presents a conflict of interest; without liability, there is little incentive for these companies to fundamentally reform their internal practices and user education around fraud prevention.

The failure to reform compensation structures signifies a broader issue in trust between consumers and digital platforms. As the U.K. prepares to implement new regulations that mandate maximum compensations for victims of authorized push payment (APP) fraud, there is an urgent call for social media platforms to align with these goals. Revolut’s push for direct compensation echoes a sentiment that, if unaddressed, could culminate in an erosion of confidence in digital financial practices. Users are left vulnerable when companies prioritize profits over protection.

As the dialogue around digital fraud continues to evolve, it is imperative for both regulatory bodies and corporate entities to brainstorm comprehensive solutions that include accountability measures for tech companies like Meta. The collaboration between financial institutions and platforms must transcend data-sharing initiatives; it requires the implementation of stringent accountability protocols. Ultimately, a sustainable model will balance user security with corporate responsibility and foster a healthier ecosystem for financial transactions.

The time for complacency in the face of fraud is over. With companies like Revolut openly challenging the status quo, the momentum is building for real change. It is now up to the industry at large, including influential players like Meta, to recognize the necessity of taking significant steps toward protecting users from financial harm, not just through rhetoric but via tangible actions that include employee training, user education, and victim compensation.