As the tension in geopolitical affairs continues to cast a shadow over global financial markets, investors in Asia are bracing themselves with a mix of caution and optimism. On a recent Tuesday, uncertainty surged due to escalating tensions between the U.S. and Russia, particularly regarding the ongoing conflict in Ukraine. However, as U.S. markets rallied and stabilized throughout the trading session, a positive sentiment began to mount in Asia, setting the stage for potential growth. On Wednesday, market participants look forward to several pivotal announcements, particularly concerning Nvidia’s highly anticipated earnings report. This marks a crucial juncture for investors, especially given Nvidia’s prominent role within the tech sector.

The Asian economic landscape is further defined by the release of significant local data on Wednesday. Among the most notable indicators are the producer price inflation figures from South Korea, alongside trade data from Japan and Taiwan. Taiwan’s export figures hold particular importance as they serve as a bellwether for global demand, especially given the export shipments from Taiwan Semiconductor Manufacturing Company (TSMC), a cornerstone entity in the chip manufacturing industry. As the world grapples with supply chain disruptions and increasing demand for semiconductors, these insights could provide a clearer picture of both regional and global economic health.

Regional monetary policy decisions are also expected to be central to market dynamics. Both China’s and Indonesia’s central banks are anticipated to maintain current interest rates, aimed at safeguarding their currencies amidst a backdrop of fluctuating geopolitical conditions. With a renewed administration in the U.S. expected next year, concerns loom over potential protectionist measures that could disrupt international trade relationships. Consequently, central banks are adopting a conservative approach, observing global trends closely while ensuring economic stability at home.

The People’s Bank of China, in particular, faces the delicate challenge of managing domestic economic pressures while navigating the global landscape. Recent decisions to keep interest rates unchanged indicate a strategic move to fortify the yuan against external shocks and to balance local economic growth amidst mounting pressures.

Geopolitical Tensions and Market Reactions

The geopolitical climate has understandably affected market sentiment, resulting in increased volatility and risk aversion among investors. Initial reports indicated a significant aggravation following revelations that the Biden administration permitted Ukraine to utilize U.S.-manufactured weapons for deeper strikes into Russia. In response, President Vladimir Putin signaled that he would lower the nuclear strike threshold owing to a broader range of conventional threats. This situation led to a spike in the VIX index, illustrating heightened fear among U.S. equity investors.

Fortunately, anxiety in the market began to ease as the day progressed. By the end of the session, major indices such as the S&P 500 and the Nasdaq witnessed a turnaround. This recovery reflected broader market resilience, with both volatility and Treasury yields showing signs of easing. Such developments are vital for the Asian market sentiments, promoting a more favorable environment for capital inflow and investment initiatives.

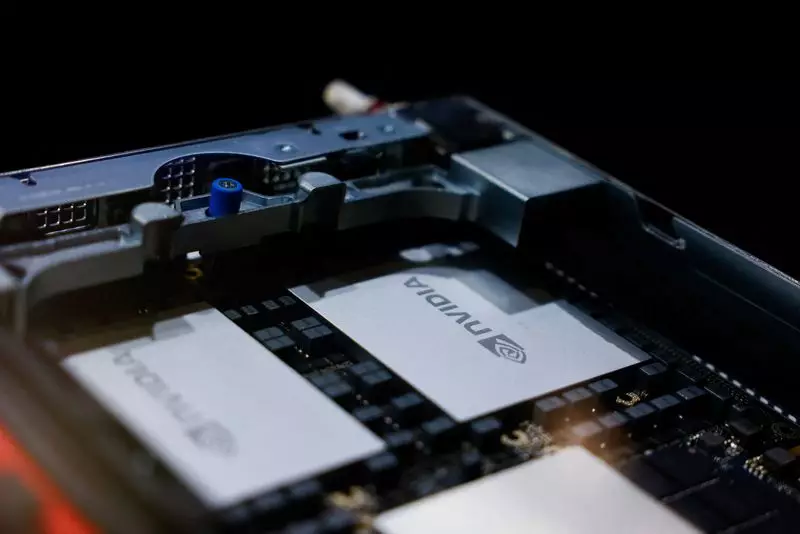

As all eyes focus on Nvidia, analysts predict an impressive leap in the company’s revenue, driven by soaring demand for its cutting-edge technology. Nvidia is projected to demonstrate an astounding 82.8% revenue growth, illustrating the company’s pivotal role in the acceleration of tech adoption across various sectors. This financial outlook not only highlights Nvidia’s significance in the tech industry but also serves as a barometer for investor confidence in technology stocks, which are increasingly becoming a focal point in Asian markets.

While the overarching geopolitical landscape remains fraught with tension, the Asian market outlook appears to be stabilizing, buoyed by careful monetary policies, significant economic data releases, and the continued momentum of key players like Nvidia. Investors are advised to remain vigilant, navigating the complexities of both local and global economic currents, as the consequences of these developments ripple across financial ecosystems worldwide.