As the calendar year winds down, Asian stock markets have seen minor upward movement amid lighter trading volumes, largely dictated by the holiday season. The continued optimism from earlier in the week reflects a market less influenced by substantial news or data influx, allowing shares to rise moderately. The isolation from major market-driving events has made it easier for investors to focus on prevailing trends, notably the Federal Reserve’s forthcoming monetary policy adjustments.

With several markets, including those in Hong Kong, Australia, and New Zealand, closed for holidays, the ongoing activity was largely driven by the remarks made by Fed Chair Jerome Powell at the most recent Federal Reserve policy meeting. His indication that fewer rate cuts may be on the horizon for next year has altered trader perspectives, subsequently adjusting pricing expectations surrounding interest rates.

Currently, market expectations suggest that traders are anticipating roughly 35 basis points in rate easing for 2025. This shift has significantly influenced U.S. Treasury yields, which have climbed in response, alongside the dollar gaining strength. The latest figures show the benchmark 10-year yield stabilizing at 4.5967%, rebounding above the 4.6% mark—an achievement not seen since late May. Additionally, the two-year yield has also experienced a firming up to 4.3407%.

Tom Porcelli, the chief economist at PGIM Fixed Income, elaborated on these market tendencies, noting, “We believe the Fed will take a pause in the January FOMC meeting to monitor more data before potentially resuming or concluding this cutting cycle.” This perspective signals that investors should brace for heightened attention toward economic indicators, especially as we transition into the new year.

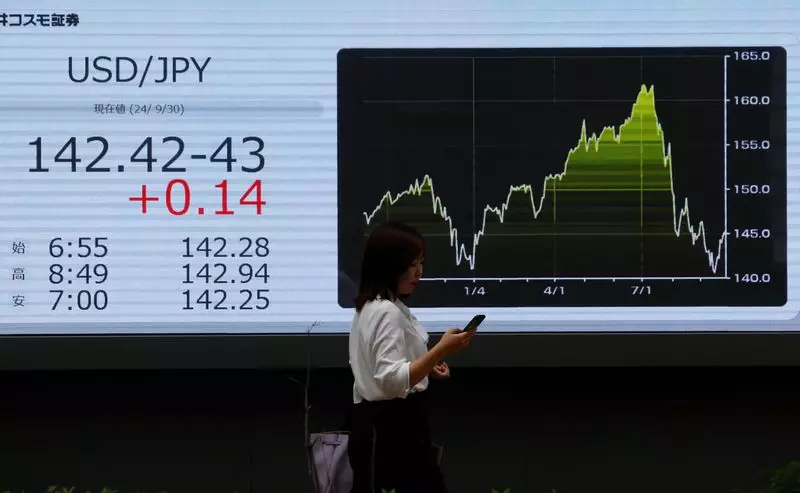

The U.S. dollar, reigning near a two-year peak against a basket of currencies at 108.15, signals a monthly increase exceeding 2%. The Australian and New Zealand dollars have emerged as notable underperformers against the dollar’s strength, with the Aussie dipping 0.45% to $0.6241 and the kiwi slipping 0.51% to $0.5650. Similarly, the euro has contracted to 0.18% against its U.S. counterpart, and the yen remains weak, hovering near a five-month low at 157.45 per dollar.

The potential for dynamic shifts in currency values reveals the precarious situation some economies find themselves in. As Japan prepares to compile a record budget of $735 billion due to escalating social security costs and substantial debt servicing obligations, such fiscal challenges weigh on the country’s economic outlook.

Regional Stock Insights and Future Projections

Overall, the MSCI Asia-Pacific index excluding Japan nudged up by 0.04%, marking a nearly 2% weekly rise, reflecting optimism from Wall Street’s earlier gains. Future contracts in the S&P 500 and Nasdaq have also been trending positively, suggesting further upward momentum may be within reach.

Across the region, Japan’s Nikkei index recorded a mild increase of 0.38%, envisioning an impressive year-end growth exceeding 17%. Meanwhile, China’s major indices, such as the CSI300 and Shanghai Composite, faced slight declines of 0.26% and 0.22%, respectively; however, both indices are ultimately looking towards yearly gains above 10% due to intensified support from government initiatives aimed at economic recovery.

Despite encountering immediate setbacks, financial analysts note a broader trend of resilience across world stock markets, highlighted by consistent recovery post-pandemic. As Vishnu Varathan of Mizuho Bank remarked, “Markets currently exude an air of exuberance, depicting a scenario of American capital driving global investor sentiment.”

In the cryptocurrency arena, Bitcoin is trading marginally higher at $98,967, having recently receded from its peak above $100,000 influenced by current market dynamics. On the geopolitical front, Russian firms are reportedly starting to engage in international transactions using Bitcoin and other cryptocurrencies, following changes in legislation to navigate Western sanctions.

Meanwhile, commodities are showing subtle movements of their own, with Brent crude edging up by 0.18% to $73.71 a barrel and U.S. crude following suit at $70.25 per barrel. Spot gold, often seen as a safe haven in volatile times, has slightly progressed by 0.5% to $2,626.36 per ounce, underscoring ongoing investor preferences for precious metals in uncertain market climates.

The landscape of Asia’s financial markets appears to be navigating a cautious yet optimistic period as the year closes. The unrelenting focus on the Federal Reserve’s rate decisions, coupled with prevailing currency trends and regional stock performances, will likely shape investor sentiment heading into 2025. As the interplay of economic indicators continues to evolve, market participants must remain vigilant and responsive to potential shifts in the ever-changing economic environment.