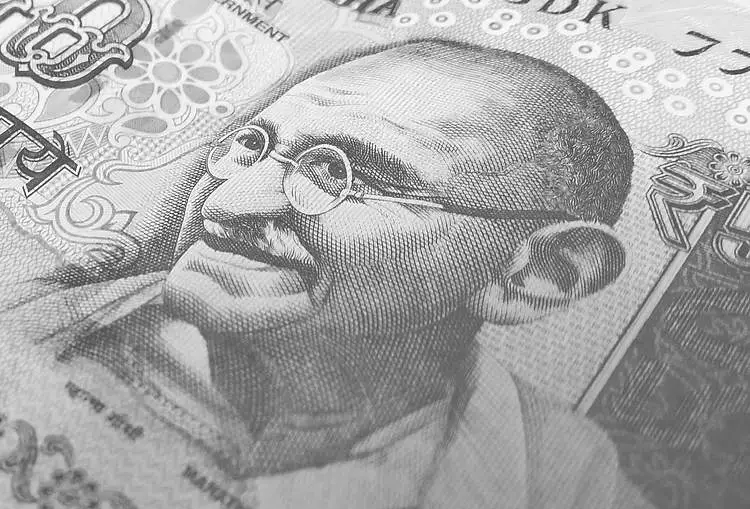

The Indian Rupee (INR) is experiencing significant pressure, observed during the early trading hours on Monday in Asia. A robust US Dollar, propelled by global economic sentiments, continues to place downward pressure on the currency. Despite the Rupee’s vulnerability, the Reserve Bank of India (RBI) seemingly aims to mitigate further depreciation through regular interventions. This balancing act creates a dynamic environment for currency traders and investors alike.

Compounding the Rupee’s challenges is the persistent decline in India’s foreign exchange reserves, which have decreased in nine out of the last ten weeks. Following an all-time high of USD 704.89 billion in September, the reserves currently sit at USD 654.857 billion—a striking indication of economic pressures. This downturn can be attributed to a higher trade deficit alongside sluggish growth indicators, which collectively put the Rupee under strain. Investors now find themselves anxiously watching the upcoming US Consumer Confidence data set for release, as such information will likely impact market dynamics further.

Analysts, such as Kunal Sodhani from Shinhan Bank India, predict a pivotal moment for the USD/INR currency pair. He suggests that the exchange rate level of 84.70 serves as a critical support base. However, trends indicate that it is not merely about holding that level; the potential for an ascent towards 85.50 remains realistic. The prevailing trade dynamics illustrate a growing risk of outflows from domestic equity markets, exacerbating the Rupee’s volatility even further.

Meanwhile, the Commerce Department in the US reported a modest rise in the Personal Consumption Expenditures (PCE) Price Index, which might reveal insights into future inflation trends and Federal Reserve policy adjustments. November’s YoY increase of 2.4%, while lower than anticipated, highlights ongoing inflationary pressures. Meanwhile, excluding volatile items such as food and energy, the Core PCE only slightly exceeded expectations, suggesting a complex interplay of factors affecting the US economy—factors that ultimately have ripples felt around the globe.

From a technical perspective, the USD/INR pair appears firmly poised for further upward movement. Trading above the 100-day Exponential Moving Average (EMA) reinforces a bullish trend, with the 14-day Relative Strength Index (RSI) hovering comfortably above neutral, at approximately 65.40. This suggests significant buying interest that could fuel bullish sentiment in the short term. If the market continues along this trajectory, the USD/INR rate could extend its reach toward the ascending channel around 85.20, and possible breakout scenarios may drive it even closer to 85.50.

However, it is essential for traders to remain vigilant regarding the potential for reversals. Any breach below the lower boundary of the channel, notably around the 84.88 mark, could open the doors for deeper declines, with an eye toward the 84.19 threshold as a possible downfall point.

The Indian Rupee’s trajectory is interwoven with complex global economic realities, marked by investor sentiment, RBI interventions, and overarching international financial trends. The landscape remains fluid, demanding a keen eye from all market participants.