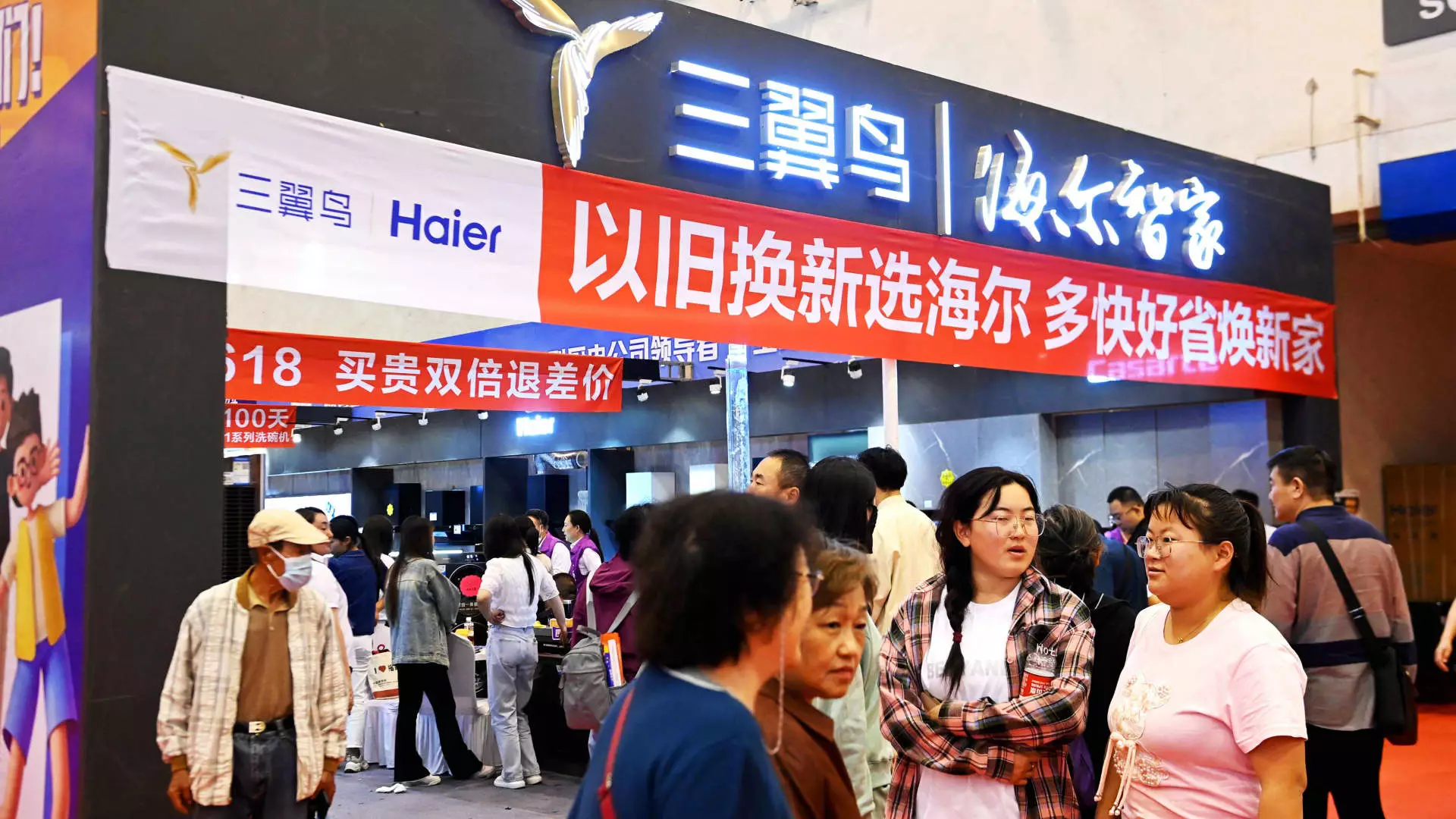

In an ambitious effort to stimulate consumption, the Chinese government has introduced a trade-in policy aimed at encouraging consumers to upgrade their household goods and equipment. Announced in July, this initiative involves allocating an impressive 300 billion yuan (approximately $41.5 billion) via ultra-long special government bonds. A sizeable portion of this funding is designed to subsidize trade-ins of cars, home appliances, and other significant consumer goods, while the remainder is earmarked for the modernization of large equipment. Despite these efforts, industry insiders express skepticism regarding the tangible benefits of the plan so far.

As is often the case with ambitious government policies, the execution of this trade-in initiative has not yet produced the desired effects. Jens Eskelund, president of the EU Chamber of Commerce in China, underscored this by stating that the realization of the benefits from the trade-in measures remains elusive. Analysts from the chamber reported that the average budget allocated works out to a mere 210 yuan ($29.50) per person, creating doubts about the scheme’s capacity to significantly elevate domestic consumption. This concern is compounded by the fact that many consumers may not have the financial means to make upfront payments required to use these subsidies, despite having trade-in items.

While the intention behind the trade-in policy is commendable, the initial reactions from the market are anything but optimistic. Tao Wang, Chief China Economist at UBS Investment Bank, projected that the new trade-in initiative might only support about 0.3% of retail sales in 2023. This modest forecast follows weaker retail sales figures, with an increase of just 2% in June being the lowest since the COVID-19 pandemic, followed by a slight rebound to 2.7% in July. Despite this slow growth, it’s worth noting that sales for new energy vehicles surged by nearly 37% in July, suggesting that certain segments of the market may be more responsive to the trade-in incentives than others.

One sector particularly influenced by the trade-in policy is the elevator industry. Notably, it was highlighted that over 800,000 elevators in China have been operational for more than 15 years, with 170,000 even exceeding the 20-year mark. However, feedback from foreign elevator companies, including Otis and Kone, indicates that they have yet to see significant new orders stemming from these trade-in programs. The initial stages of the program have led to a general sense of optimism among executives, but as Otis’s Sally Loh mentioned, clarity regarding fund allocation and implementation specifics remains elusive.

While the trade-in initiative may have fallen short in delivering immediate results, experts believe it could lay the groundwork for the future growth of the secondhand goods market in China. Executives from the secondhand retail sector, such as ATRenew, recognize that while short-term impacts may not be evident, the government support will likely prove vital for longer-term development. Reports of increased trade-in volumes for specific categories on platforms like JD.com demonstrate a growing consumer engagement with the concept of trade-ins, signaling a potential shift in consumer behavior over time.

Ultimately, while China’s trade-in policy is rooted in a noble ambition to spur consumption, the initial reactions and market responses suggest a significant gap between intention and execution. As local governments and businesses grapple with practical implementation, clarity on fund allocation and tangible consumer benefits is paramount. Moving forward, it will be essential for stakeholders to focus on refining this ambitious initiative to ensure it transitions from a strategic plan into a proven framework that actively stimulates growth in the domestic market. Without tangible results, the grand ambitions of policymakers may risk stagnation amidst a cautious consumer landscape.