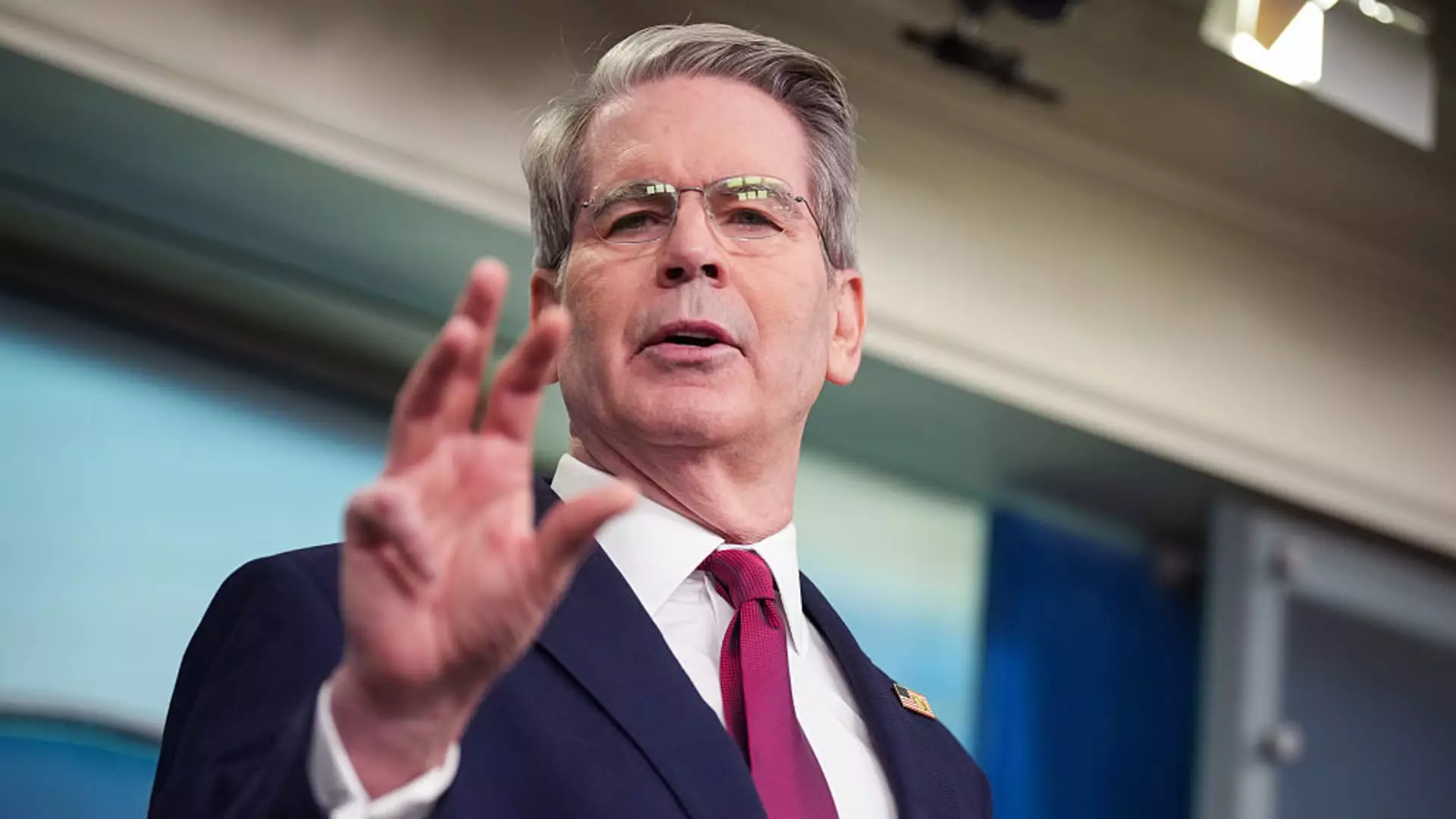

In an era where market sentiments can waver as quickly as the stock prices themselves, it’s noteworthy to observe the steadfast nature of individual investors. Amid the recent fluctuations incited by President Trump’s controversial tariff policies, Treasury Secretary Scott Bessent highlighted a striking fact: these individual investors have exhibited remarkable resilience. While institutional investors, often perceived as the titans of the market, have reacted in panic, individual investors seem to be holding tight to their positions and their faith in the Trump administration’s economic roadmap.

Bessent pointed out that a significant 97% of Americans haven’t made any trades over the past three months, a statistic provided by Vanguard, one of the most substantial players in asset management. This suggests that individual investors are not merely following the frantic waves created by institutional players but rather maintaining their long-term strategies, perhaps as a sign of their confidence in the direction the administration is taking.

Market Doldrums: The Roller Coaster Effect

The impact of Trump’s tariff announcements has been nothing short of tumultuous for the markets, causing a steep sell-off. At one moment, the S&P 500 index nosedived into bear market territory—an alarming signal for even the most seasoned investors. However, it’s critical to analyze why retail investors, often portrayed as market followers, have diverged from the typically herd-like behavior exhibited by larger institutional investors.

As stock prices plummeted, retail investors adopted a contrarian stance, seizing the opportunity to buy into stocks at discounted valuations. Their actions have been reminiscent of a phoenix rising from the ashes—capitalizing on opportunities rather than succumbing to fear. This behavior demonstrates a nuanced understanding of market dynamics that challenges the narrative that only institutional investors hold the aces in these turbulent times.

The Tariff Dilemma: A Double-Edged Sword

However, it’s crucial to recognize the broader implications of these tariff policies on economic stability. As highlighted by Torsten Slok, chief economist at Apollo, the fear of an impending recession—sparked by trade-related shortages—lingers on the horizon. The stark contrast in belief between individual and institutional investors raises questions about the sustainability of this trust in the administration’s policies.

Ken Griffin, the founder of Citadel, echoed the sentiment that these global trade disputes may tarnish the image of the United States as a strong economic nation. This potential image crisis could have far-reaching consequences—not just for market sentiment but also regarding the international attractiveness of U.S. Treasury debt. If the euphoria surrounding the current administration’s tariff strategies diminishes, will investors continue to back the American economy, or will individual convictions falter in the face of institutional skepticism?

A Pivotal Moment for Market Sentiments

The juxtaposition of individual investors’ resilience against institutional hesitancy evokes a deeper dialogue about market psychology. What societal beliefs and values contribute to this dichotomy? While institutional investors may operate based on immediate market data, the trust that individual investors place in political leadership speaks to their long-term vision and commitment to the American economic narrative.

As the market continues to navigate through the uncertainties placed before it, one thing is certain: the actions of these two investor categories could shape the economic landscape for years to come. It poses a compelling inquiry into whether the steady hands of individual investors can indeed counterbalance the hesitations of institutions, and as history unfolds, it may redefine the contours of investor confidence itself.