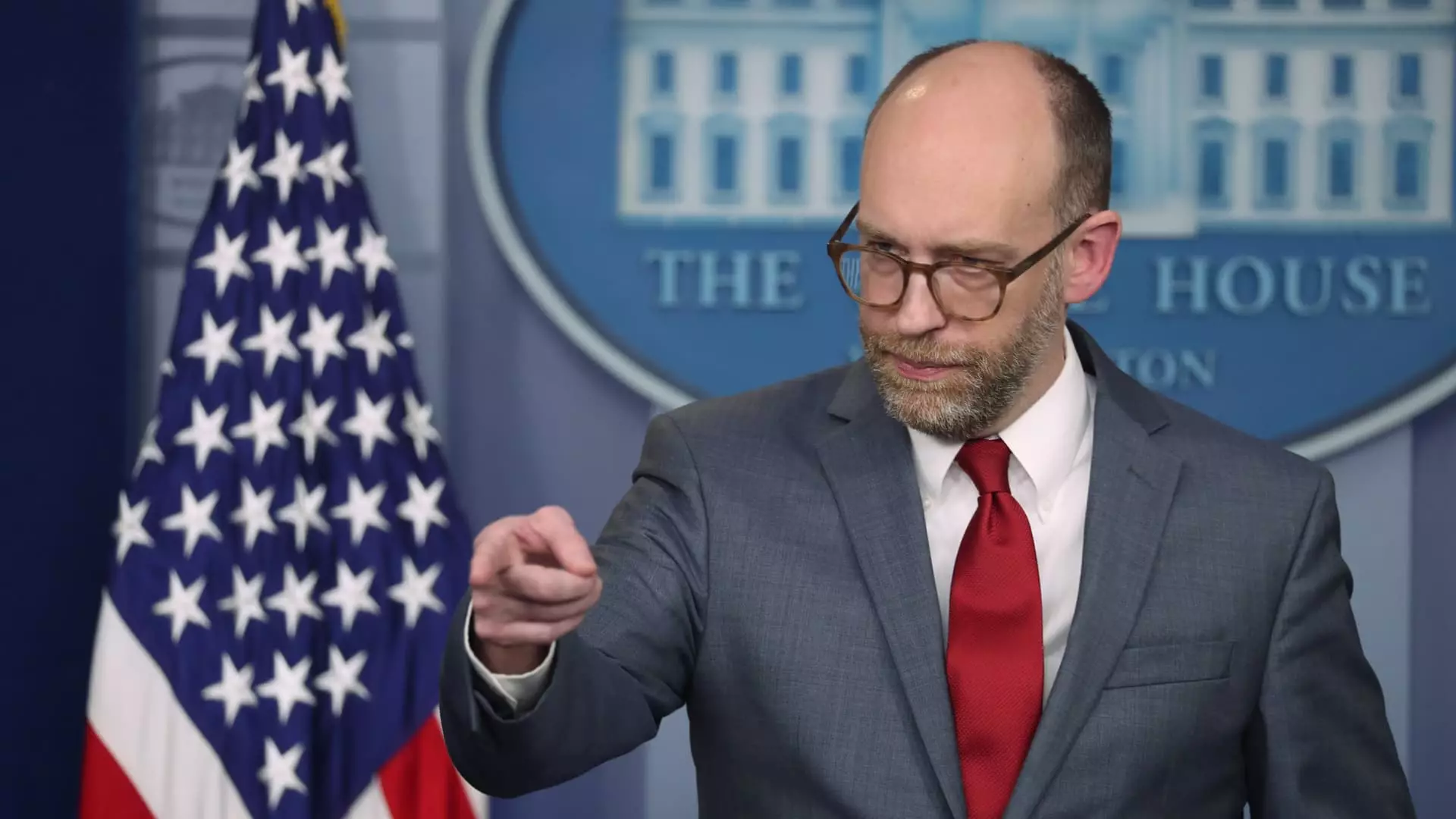

The Consumer Financial Protection Bureau (CFPB), established to safeguard consumer interests following the 2008 financial crisis, now finds itself in a precarious situation. A recent memo from the agency’s Chief Operating Officer, Adam Martinez, announced a transition to remote work for all employees until February 14. This directive signals an alarming shift in operations, particularly after a weekend that featured subsequent orders from the CFPB’s new acting director, Russell Vought, aimed at halting most agency activities, including the supervision of financial institutions. In doing so, Vought has fostered an atmosphere of uncertainty that extends beyond procedural adjustments, raising critical questions about the CFPB’s future.

Recent reports indicate that personnel from Elon Musk’s DOGE, a group purportedly affiliated with him, have acquired access to CFPB’s sensitive data. Such developments are concerning, as they compromise the integrity and confidentiality of information that is vital to the bureau’s operations. Insiders, speaking anonymously due to concerns about reprisal, have highlighted that these external operatives have started to delve into confidential staff performance reviews. The involvement of private entities poses significant risks, undermining the regulatory authority that the CFPB has long exercised over financial firms, which ultimately detracts from its mission to protect consumers.

A Climate of Fear Among Employees

The atmosphere within the CFPB has shifted toward apprehension as employees grapple with the unsettling possibility of administrative leave or layoffs. This sentiment echoes the experiences of employees at other agencies that have faced similar threats during the current political climate, notably the U.S. Agency for International Development (USAID). With the CFPB employing around 1,700 individuals, only a fraction—reportedly a few hundred—are in positions that are legally required to remain intact. This precarious employment landscape raises concerns that mass layoffs could severely hinder CFPB’s ability to fulfill its critical mission of consumer protection.

Vought’s sweeping changes are more than mere administrative shifts; they represent a calculated maneuver to stifle the agency’s capacity for effective oversight and accountability. In his directive, Vought remarked on halting fresh funding for the CFPB, calling this “the spigot” that has contributed to the agency’s alleged unaccountability. This deliberate chokehold on resources risks dismantling critical consumer protections, which include efforts to regulate exorbitant credit card fees and manage overdraft charges that disproportionately affect financially vulnerable constituents. The agency has previously spearheaded initiatives projected to save consumers potentially tens of billions of dollars, efforts now endangered by the current initiatives unfolding under the new leadership.

The very foundation on which the CFPB was constructed is now under siege. Established in response to the financial malfeasance observed during the 2008 crisis, the agency has made remarkable strides in regulating financial institutions and fostering consumer awareness. Yet, it faces staunch opposition from banking trade groups who have long criticized the CFPB’s methods as overreaching and have contested its constitutionality in courts. As these external pressures mount, vulnerable consumers stand to bear the brunt of potential shifts in policy that could reverse years of progress in financial protections.

As we observe the CFPB navigate this challenging landscape, its future remains uncertain. The convergence of leadership changes, external influences, and funding restrictions creates a volatile environment that jeopardizes the agency’s mission of consumer protection. In a climate where consumers have historically been the targets of exploitative financial practices, the possible erosion of the CFPB’s authority poses significant risks. Ultimately, vigilance from both consumers and advocates will be crucial as we monitor the unfolding narrative surrounding the CFPB and the broader implications for financial regulation in America.