The Swiss Franc (CHF) has recently experienced an uptick against the Euro, marking a notable shift in market dynamics as investors gravitate towards this safe-haven currency. Such movements are typically fueled by apprehensions surrounding political uncertainties in the Eurozone, particularly given its status as Switzerland’s primary trading partner. In times of instability, currencies perceived as stable and secure often gain favor, prompting questions about the potential repercussions for Switzerland’s export-driven economy.

Recent events in France, particularly involving the political maneuvers of left and far-right factions, have stirred unease across the Eurozone. The ousting attempts against Prime Minister Michel Barnier, catalyzed by aggressive budget cuts, reflect a broader trend of instability within European politics. These developments have led to safety-seeking behaviors among investors, yet they have not drastically weakened the Euro against the Franc. While there’s no question that Switzerland could be negatively affected by a robust Franc—potentially hampering its competitive edge in exports—the recent fluctuations suggest that the situation is being monitored closely without immediate alarm.

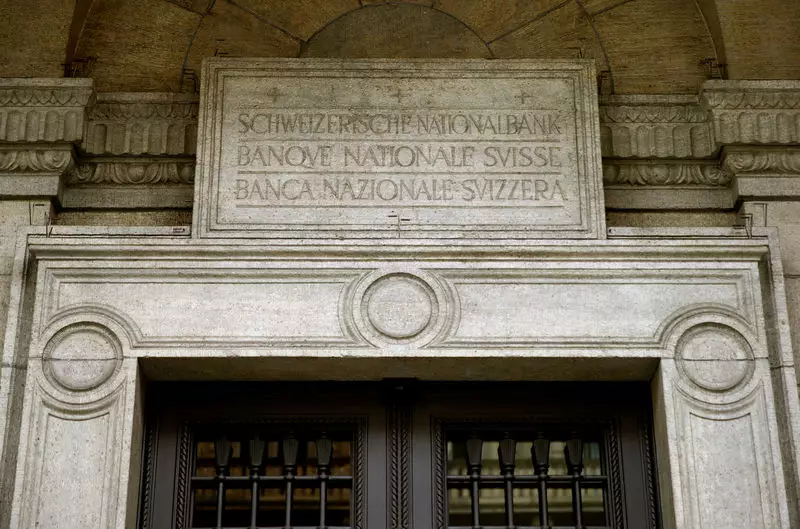

Bank of America’s analysts provide keen insights into this situation, indicating a lack of significant outperformance by the Franc against its G10 counterparts. This observation suggests that fears may be somewhat exaggerated. They argue that the recent depreciation of the Euro relative to the Franc can largely be attributed to short positions rather than pronounced safe-haven inflows. The lack of substantial movement in CHF, particularly when paired against other currencies, indicates that the Swiss National Bank (SNB) might not perceive the immediate need to intervene.

Furthermore, December has historically leaned towards weaker EUR/CHF exchanges, as evidenced by a trend of declines in seven out of the last ten years during this month. This seasonal tendency raises further questions about the underlying mechanisms driving current currency trends; investors may not be reacting purely based on political news but rather adhering to established market patterns.

With the market exhibiting signs of mild concern rather than outright panic, the SNB appears content to refrain from aggressive rate cuts or interventions for the time being. This stance might change if the Franc significantly outperforms its peers, but current trends do not signal an impending crisis. Analysts emphasize that the bank’s strategy hinges on maintaining stability in the foreign exchange market while being vigilant of potential shifts influenced by geopolitical events.

As attention remains focused on the CHF as a sanctuary against Eurozone instability, analysts suggest potential opportunities in bearish positions on the Franc when compared to currencies like the GBP and USD. Such positions could provide leverage in trades where policy divergences are more pronounced. Ultimately, the Swiss economy may face challenges from a stronger Franc, yet current conditions indicate a cautious landscape rather than an urgent cause for alarm. The interplay of political dynamics, currency valuation, and monetary policy will be crucial in shaping the future trajectories for the Swiss Franc amid ongoing uncertainties.