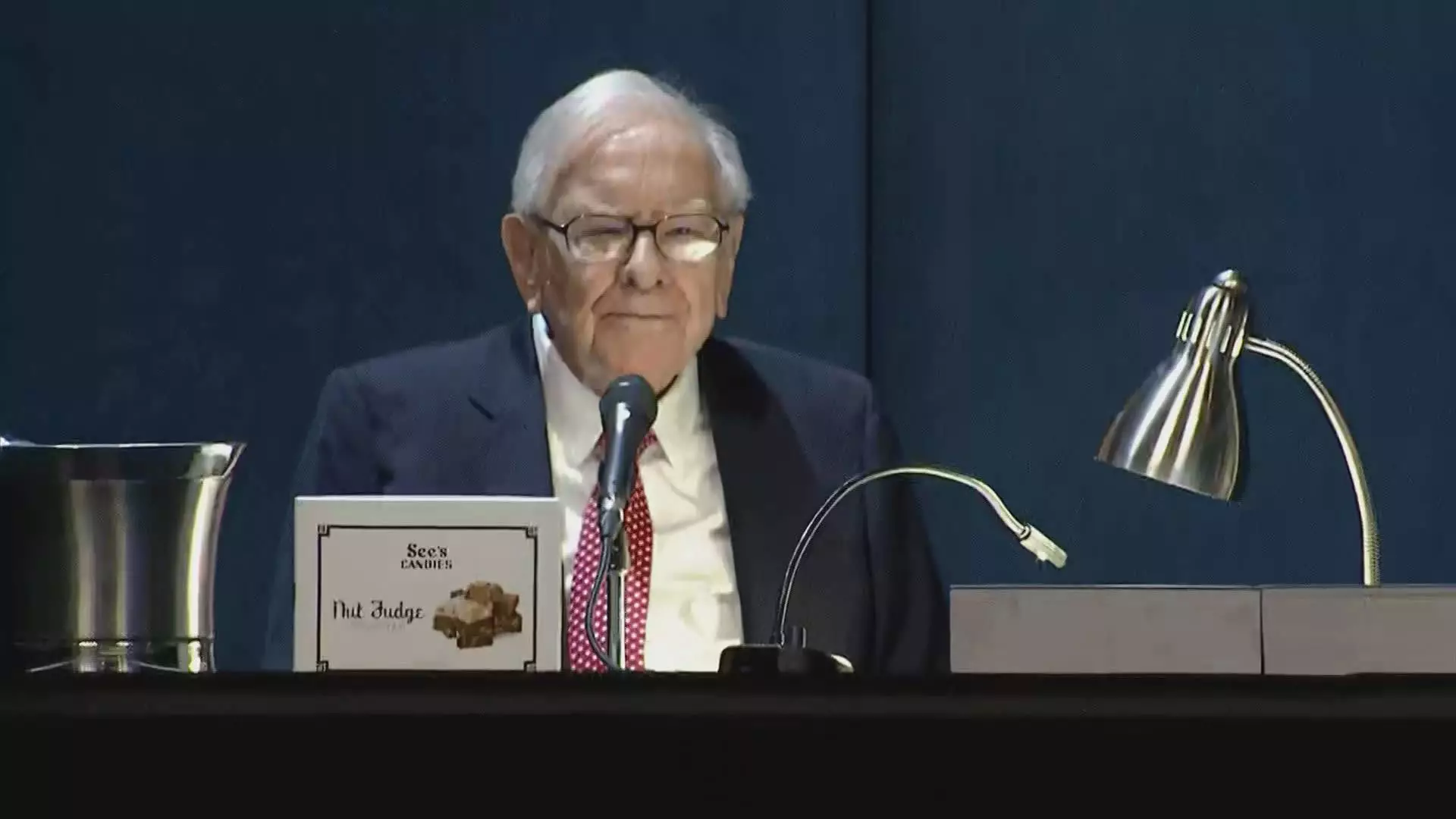

Warren Buffett, the CEO of Berkshire Hathaway, has made headlines once again with his decision to sell off a significant portion of his Apple holdings. This strategy marks a continuous trend over four consecutive quarters where the Omaha-based conglomerate has reduced its stake in what was once its largest equity investment. As of the end of September, Berkshire Hathaway’s interest in Apple amounted to a staggering $69.9 billion. Buffett’s divestiture raises questions about the motivations behind such actions and the broader implications for investors observing his unique investment philosophy.

Buffett’s latest move indicates a reduction of approximately 25% in his Apple shares, bringing the total to around 300 million. Comparatively, this figure reflects a dramatic 67.2% decrease from the same quarter the previous year. Such a substantial reduction is not merely a casual adjustment but signals deeper strategic thinking regarding market conditions and the firm’s portfolio composition. Investors are left pondering whether this decision stems from concerns over inflated stock valuations or an effort to diversify Berkshire’s investments to mitigate risk.

The Rationale Behind the Decision

There are several theories about why Buffett began this selling spree, particularly his unusually aggressive offloading of shares halfway through the year when he sold nearly half of his Apple stake. The potential for higher capital gains taxes looms in the backdrop, as Buffett hinted at during the annual shareholder meeting. He suggested that tax implications may lead to more strategic selling, especially if future regulations threaten to increase the tax burden on capital gains. However, many investors speculate that the scale of these sales indicates that Buffett’s motivations might extend beyond merely capitalizing on tax strategies.

Buffett’s investment journey with Apple is particularly intriguing, given his historical reluctance to engage with technology stocks prior to 2016. His partnership with investing lieutenants Ted Weschler and Todd Combs paved the way for this paradigm shift, as they championed Apple’s potential. Buffett’s admiration for Apple stemmed from its loyal consumer base and the “stickiness” of the iPhone ecosystem, which he viewed as crucial to its long-term viability. Over the years, his investment in Apple evolved, transforming it into a cornerstone of Berkshire Hathaway’s equity portfolio.

As Buffett continues to sell portions of his stake in Apple, Berkshire Hathaway’s cash reserves soar to an unprecedented $325.2 billion. This cash stockpile provides the company with flexibility and opportunities for future investments but also raises questions about Buffett’s investment philosophy and strategies moving forward. Notably, during the same period, Berkshire completely halted share buybacks, reflecting a cautious approach amid market uncertainties.

The ongoing reduction of Buffett’s Apple stake represents a significant shift in his investment strategies, as he navigates the complexities of the current market landscape. The distinct possibility of the U.S. government increasing capital gains taxes may prompt further adjustments in his portfolio, aimed at maximizing returns while minimizing exposure. As Buffett continues to evolve his approach to investment, both seasoned investors and newcomers will undoubtedly scrutinize his moves, hoping to glean insights into the shifting dynamics of the investment world. These developments remind us that even seasoned veterans like Buffett must be adaptable in an ever-changing financial climate.