The US dollar has recently displayed a nuanced performance, oscillating between moments of strength and vulnerability. With geopolitical tensions and domestic fiscal policies shaping its trajectory, the dollar’s fluctuations are drawing the attention of traders, investors, and economists alike. As market participants assess the implications of China’s economic maneuvers and U.S. Federal Reserve pronouncements, the greenback’s fate remains a topic of considerable debate.

After a pronounced rally, the US dollar appears to be consolidating its gains, particularly in light of China’s recent economic stimulus initiatives. Market sentiment has been bolstered by announcements regarding deposit rate cuts aimed at invigorating domestic demand. These measures are critical as they underscore China’s commitment to sustaining economic growth amidst a turbulent global climate. Such steps could provide an immediate cushion for the Chinese markets, leading to improvements in indices across Asia.

As reports surface about the potential for a slowdown in key US housing market indicators, including building permits and housing starts, traders are closely monitoring the upcoming data releases. Scheduled for release at 12:30 GMT, this data could act as a bellwether for future trends in the economy. Predictions suggest a slight decline in housing permits, from 1.47 million in August to a forecast of 1.46 million in September, while housing starts are expected to dip slightly as well. These critical metrics will likely shape the near-term sentiment surrounding the US dollar.

Response to Economic Indicators

Today’s scheduled speeches from various Federal Reserve officials are poised to offer insights into U.S. monetary policy. At 13:30 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic will speak at an event aimed at educating high school students about economics, which, while seemingly innocuous, could provide reflections on the Fed’s ongoing communication strategy. Following this, another critical discussion will unfold at 14:00 GMT featuring Federal Reserve Bank of Minneapolis President Neel Kashkari, which may delve into broader economic perspectives.

At the same time, Federal Reserve Governor Christopher Waller is expected to address decentralized finance at the Vienna Macroeconomics Workshop, where his remarks could shed light on the Fed’s approach to emerging financial technologies and trends. All these insights could further shape expectations for monetary policy, given the close relationship between interest rates and the strength of the dollar.

Current market forecasts indicate a 90.2% probability of the Federal Reserve implementing a 25 basis point (bps) rate cut when it meets on November 7. This forecast reveals a significant consensus among market players, rendering it unlikely that a deeper cut will occur, as evidenced by the negligible probability of a 50 bps reduction. The dynamics of the financial landscape remain closely tied to these interest rates; consequently, a rate cut may influence the currency’s volatility even more strongly.

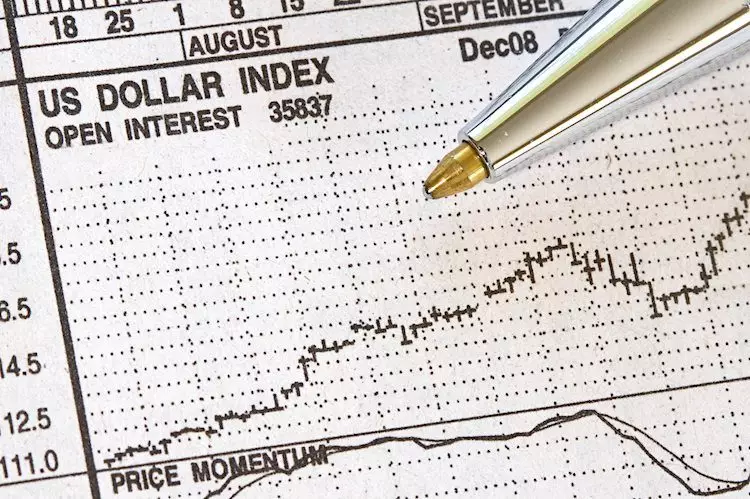

The US 10-year benchmark yield has recently hovered around 4.11%, flirting with levels that hint at a potential downward break. Meanwhile, the dollar index rallies appear to be stuttering at critical resistance levels, with 103.80 standing out as a pivotal threshold. Should the dollar push past these barriers, we could see significant moves, especially if domestic political developments—such as Donald Trump’s increasing poll numbers—shift market perceptions further.

Understanding the US dollar’s recent performance also benefits from historical context. The banking crisis that unfolded in March 2023 revealed vulnerabilities within the banking sector. High-profile cases like the collapse of Silicon Valley Bank (SVB) exemplified how quickly investor confidence could erode. The subsequent fallout cascaded through the financial industry, compelling federal interventions and adjusting investor expectations regarding interest rates.

This crisis illustrated the interconnectedness of traditional finance and regulatory policies. As fears of increasing default rates emerged, expectations shifted from aggressive rate hikes to a more cautious approach that favored maintaining liquidity within the banking system. The dollar weakened as investors recalibrated their outlook, differentiating between Federal Reserve policies and actual economic health.

Meanwhile, the inflationary pressures which had previously guided Fed policy decisions tempoed out against the backdrop of financial instability. In such moments, alternative assets like gold rallied, as their intrinsic value remained secure in comparison to the dollar’s fluctuating strength.

The current landscape for the US dollar reflects a complex interplay of localized and global market dynamics. While recent trends indicate the possibility of stabilization or rallying, much remains contingent upon forthcoming data releases and policymaker communications. The ongoing struggle for balance—between fostering economic growth, accommodating inflation, and maintaining financial stability—will undoubtedly play a pivotal role in determining where the dollar heads next. Ultimately, the path forward is laden with uncertainty, warranting keen observation and strategic adaptability from all market participants.